"But That's Not Pricing!" (...yes, it is...)

- John Norkus

- Apr 20, 2025

- 14 min read

"But that's not pricing!"

The words hung in the air during my recent catch-up with Daniel Beaumont (not his real name), now CIO for a portfolio company owned by one of the largest private equity firms in the world. We'd started our careers together at the same consulting firm two decades earlier. He'd gone the client-side route while I'd stayed in professional services.

I'd been sharing my observations about how AI was eliminating billable hours, how firms needed new commercial models, how PE firms were injecting capital into professional services firms to fuel transformation, and how compensation structures needed radical reimagining to support these changes.

That's when he interrupted with those four words.

I paused, somewhat taken aback by his reaction. "What do you mean?"

"You're talking about business models, compensation systems, capital structures—not pricing," he explained. "What you're describing is a fundamental transformation of how professional services firms create and capture value. But to call it 'pricing' misses the scope of what needs to be accomplished."

Daniel wasn't dismissing the importance of what I was describing. As someone who had spent years inside professional services before moving to the client side, he understood the complexities of these firms intimately. His challenge wasn't about the concept but about the label.

"The problem," he continued, "is that when most people hear 'pricing,' they think of rates, discounts, and negotiations—tactical elements handled by middle management. What you're describing is far more strategic."

He was right about how the term is typically understood. Yet after decades of leading transformations across professional services firms, I'd come to recognize an essential truth:

Pricing isn't just a component of the business model. It's the thread that connects all other components.

The question isn't whether your firm needs sophisticated pricing leadership. The question is whether recognizing the broader scope of what pricing encompasses might help connect and enhance your other transformation efforts.

This misconception—that pricing is merely about setting rates—can limit meaningful transformation in professional services today. It's why many firms treat pricing changes as isolated tactical adjustments rather than seeing them as connected to broader business model considerations. As AI rapidly eliminates the billable hours that have powered professional services firms for over a century, a more integrated understanding of pricing becomes increasingly valuable.

The Professional Services Paradox

"And why would anyone want to hire YOU to help them fix this?"

That blunt question came from a recently retired partner at a global professional services firm. We were discussing these same issues over coffee, and while he agreed with my analysis of pricing's central role, he saw a fundamental paradox.

The irony wasn't lost on me. After three decades building and leading pricing and commercial transformation practices at multiple global firms, including two Big Four organizations, I was being asked to justify why firms would seek my experience on a topic I'd spent a career mastering. But his challenge wasn't really about my qualifications—it was about the organizational dynamics of professional services firms.

"Professional services firms are filled with fiefdoms," he explained. "Partners who consider themselves experts in delivery models, marketing, go-to-market strategies, industry needs—they each guard their territory. Why would they ever cede authority to a central coordinator of profitability through pricing?"

His question cuts to the heart of a profound irony. Professional services firms excel at helping clients transform their businesses. They diagnose siloed thinking, resistance to change, and failure to coordinate across functions as primary obstacles to client success. Yet these same firms often display identical behaviors when it comes to their own operations—especially around their definition of pricing.

This resistance explains why most "pricing investments" in professional services take such limited forms:

Training programs that offer partners pricing tips and tricks

Information systems that induce reluctant compliance to standardized processes

Pricing specialists with limited authority to influence broader business decisions

These approaches treat pricing as a discrete skill or isolated process rather than the coordinating function it needs to be. It's the equivalent of a doctor prescribing aspirin for a patient with a systemic infection.

Price Touches Everything

Price touches everything and everything touches price. This simple truth reveals why pricing is so complex and why isolated attempts at improvement typically disappoint.

Pricing isn't just a number on a page. It influences—and is influenced by—every aspect of a professional services firm: commercial models, compensation structures, client selection, service delivery, technology decisions, and financial infrastructure. Each of these elements must work in harmony for pricing to be effective.

This complexity explains why treating pricing as a tactical issue—making isolated adjustments without addressing the broader ecosystem—inevitably produces disappointing results. It's like adjusting the thermostat in a room that has the fireplace burning – the rest of the house is going to get cold.

As AI rapidly eliminates billable hours—the foundation upon which most professional services firms have built their businesses for over a century—this interconnected nature of pricing becomes not just important but critical to survival.

In our series on adValorem, we've examined each of these interconnected elements:

Commercial Model: In "The Billable Hour Paradox" and "The Great Decoupling," we explored how AI is forcing firms to decouple price from effort—a fundamental shift that transforms how value is created, measured, and captured.

Compensation Structure: "The Margin Mirage" revealed how traditional metrics and compensation systems drive behaviors that contradict the firm's long-term interests, especially as AI transforms service delivery.

Client Selection: "The Investment Fallacy" demonstrated how poor portfolio management leads to investing in clients who will never deliver adequate returns—a problem exacerbated by AI's compression of delivery hours.

Value Articulation: "Price Doesn't Matter, Until It Does" and "The Anatomy of a Fully Informed Price" showed how firms struggle to articulate value in ways that transcend hours—precisely what's needed as AI eliminates those hours.

Decision Support: "The Choice Architect" and "The Discipline Paradox" explored how firms can create environments that support better pricing decisions through thoughtful structures and governance.

Change Leadership: "The Change Challenge" examined why some leaders leave—and others transform their firms—in response to these fundamental shifts.

What's striking is how each of these elements connects back to pricing. These threads are woven into the very fabric of how professional services firms create and deliver value.

The Consulting CEO's Perspective

"I finally get it," admitted Rebecca Taylor (not her real name), CEO of a mid-sized consulting firm. We'd been working together on how AI was reshaping their business economics when she had what she called her "lightbulb moment."

"We've been treating pricing like a tool that needed tuning—something to address when we're losing deals or facing margin pressure," she explained. "But I now see how it connects and influences so many aspects of our business. Our business model flows through how we price our services."

Her realization came after months of frustration with piecemeal approaches that weren't producing results. They'd tried value-based pricing without changing compensation. They'd implemented AI without adjusting delivery models. They'd talked about focusing on high-value clients while incentivizing partners to chase any available revenue.

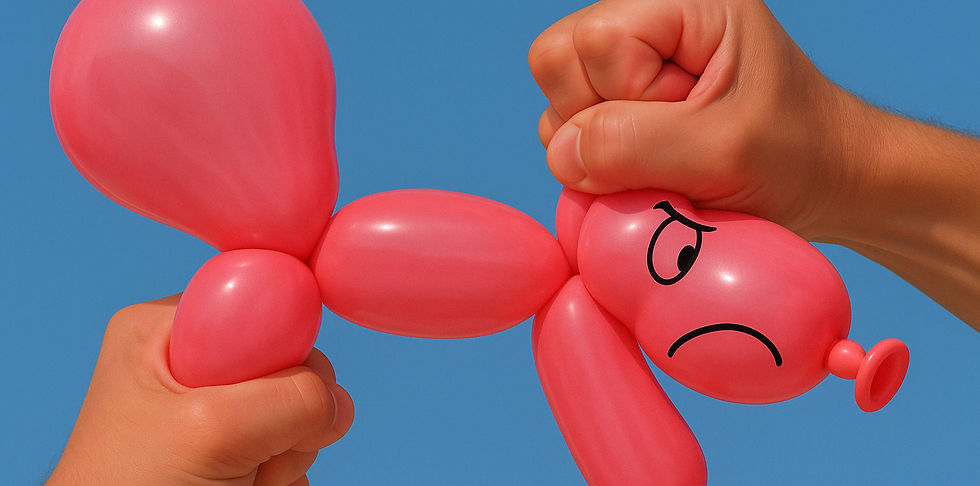

"It's like squeezing a balloon," she noted. "We'd push down in one area only to see issues bulge out somewhere else. Now I understand we need to reshape the approach."

Rebecca's insight reflects the growing recognition among forward-thinking leaders that pricing transformation isn't a discrete initiative—it's a reframing of how professional services firms create and capture value.

Four Myths About Pricing

The misunderstanding about pricing extends beyond my CIO friend. It permeates professional services, manifesting in five persistent myths:

Myth 1: Pricing is primarily about rates and discounts.

Reality: Pricing encompasses the entire framework for how value is created, communicated, and captured. Rates are merely the visible manifestation of deeper strategic choices; in fact, the notion of hourly rates may be going away entirely.

Myth 2: Pricing can be transformed without changing compensation.

Reality: Compensation drives behavior. If you don't align how people get paid with how you want them to price, transformation will inevitably cause frustration and miss expectation.

Myth 3: AI efficiency gains should be passed directly to clients through lower prices.

Reality: AI changes the nature of value creation—from effort to outcomes. Pricing should reflect this shift rather than simply reducing prices proportional to reduced effort.

Myth 4: Pricing innovation is primarily about sophisticated methodologies.

Reality: Successful pricing is about articulating client value clearly, not about complex internal frameworks. The most effective pricing approaches start with understanding what clients truly need (Capacity, Output, Outcome, or Capability) and communicating value in those terms, rather than focusing on methodological sophistication that clients don't care about.

Myth 5: Training and systems are primary drivers of pricing transformation.

Reality: Training and systems are primarily tools to institutionalize success long after improvements have been proven in progressive, bite-sized chunks. Firms often mistake these implementation mechanisms for the transformation itself, investing heavily in enterprise-wide training and systems before demonstrating value through targeted pilots. Real transformation starts with small, focused successes that build momentum and prove the approach before scaling through training and systems.

These myths explain why so many pricing initiatives start with a cheer and end with a sigh. They treat pricing as a technical problem to be solved rather than a strategic capability to be built.

What makes this particularly problematic for professional services firms is the rapid acceleration of AI. With technology eliminating billable hours, clinging to these myths isn't just inefficient—it's needlessly bleeding profits.

Five Critical Connections

If pricing is truly the thread connecting aspects of professional services, what are the most critical connections we need to address?

1. Pricing and Compensation

The strongest connection—and often the most problematic—is between pricing and compensation. Most compensation systems in professional services reward behaviors that directly undermine the fundamentals of good pricing:

Emphasizing individual performance over firm-wide profitability

Focusing on short-term cash generation rather than long-term value

Rewarding volume more than margins

Measuring utilization instead of client outcomes

Failing to incentivize strategic investments in client relationships

One firm I worked with demonstrated this disconnect clearly. They'd implemented a comprehensive value-based program including tiger-team support staff but maintained a compensation system that rewarded partners based on delivery hours and utilization. After an initial spike in deal volume, it only took six months to bring the frequency of value-based deals back to pre-program levels.

"We thought we could change pricing without changing compensation," the CFO admitted. "That was our fundamental mistake."

The most forward-thinking firms are now linking compensation directly to client value-building approaches. They're creating incentives for partners who make strategic investments in high-potential relationships, rewarding those who use client portfolio tools effectively, and measuring long-term value creation rather than just annual revenue. These incentives directly connect to the financial frameworks discussed in section four, creating a closed loop between investment decisions and individual rewards.

2. Pricing and Service Delivery

The relationship between pricing and service delivery transcends mere cost considerations—it's about fundamentally aligning with what clients truly value. As we explored in "Clearing the Fog," clients need four fundamental things:

Add Capacity: Provider will assist in work the client is controlling

Deliver Output: Client needs a specific thing the provider will deliver

Drive Outcome: Provider will deliver measurable impact on the client's business

Provide Capability: Provider will deliver ongoing service at specified levels

While AI does dramatically change delivery economics, the more profound opportunity is in creating offerings that better align with client needs and their willingness to pay. This extends beyond redesigning resource models to rethinking the very nature of how value is delivered.

One technology consultancy recognized this connection early. "We used to sell our methodology and staff projects based on decades-old models," their COO explained. "Now we structure our offerings around what clients truly value—and price accordingly."

Service catalogs and well-defined offerings provide what we've previously called "the freedom of the frame"—clear boundaries that enable creativity rather than restricting it. As AI capabilities reduce reliance on human hours, firms can move beyond the traditional tradeoff between customization and scale. The result is a fundamental shift: pricing becomes a natural extension of value rather than a negotiation over effort, and firms can focus on how to serve differently rather than just how to price differently.

3. Pricing and Client Portfolio

Client selection is indeed crucial, but the more strategic perspective views this as portfolio management rather than individual client decisions. Professional services firms need a systematic approach to evaluating their entire client base—not just reacting to opportunities as they arise.

Different firms segment their portfolios in different ways depending on their business model maturity. Some categorize by service type, others by industry, still others by relationship pattern. The most sophisticated establish formal portfolio criteria that guide both new client acquisition and ongoing investment decisions.

As we discussed in "The Investment Fallacy," many firms invest heavily in clients who will never deliver adequate returns. The portfolio approach makes this visible and actionable.

One accounting firm transformed their profitability by explicitly connecting pricing and client portfolio management. After categorizing their entire client base, they took decisive action with those showing a track record of "chronically underperforming," raising prices by 15%.

"Because our quality must exceed a high standard, there is no dialing-up or dialing down our service," their Managing Partner noted. "However, pointing that level of quality at those who are willing to pay for it is a win-win proposition."

This culling of underperforming relationships through price action is often the most practical first step in portfolio management. It creates capacity for higher-value work while sending clear signals about the firm's value proposition.

4. Pricing and Finance

A critical connection that often goes unaddressed is between pricing and finance. As firms move beyond traditional time-based billing, financial systems and processes must evolve to support new commercial models.

Value-based pricing and subscription arrangements fundamentally change cash flow patterns. Projects that once generated revenue throughout their lifecycle may now be tied to specific milestone payments or spread across longer subscription periods. This creates a financing challenge that most partnership models aren't designed to handle.

"Our compensation model assumes we get paid as we work," one Managing Partner explained. "When we started using value-based pricing with payments tied to outcomes, we had to reimagine our entire approach to cash flow management."

Finance also plays a crucial role in investment allocation and tracking. When firms make deliberate investments in strategic clients or new service development, these investments need formal budgets and performance tracking. Without this financial infrastructure, pricing initiatives around strategic investments quickly devolve into ad hoc discounting with no accountability.

The most successful firms establish clear financial frameworks that support their pricing strategy:

Capital allocation processes for client investments

Cash flow models for alternative pricing approaches

Financial tracking of strategic investments

Performance measurement tied to value creation, not just effort

As one CFO told me, "Finance used to be the department that tracked hours and sent bills. Now we're the strategic engine that enables new ways of creating and capturing value."

5. Pricing and Governance

Pricing governance isn't merely about operational guidelines—it's about elevating pricing to its rightful place among the strategic profit drivers of the firm. While most organizations have clear ownership structures for other profit levers like volume (sales), cost (operations), and mix (industry/client strategy), pricing frequently lacks this strategic voice in the C-suite.

The result is a fundamental imbalance in how profit decisions are made. As we explored earlier, "price touches everything and everything touches price," yet pricing decisions often occur without the cross-functional coordination needed to ensure strategic alignment.

True pricing governance starts with recognizing pricing as a strategic function that deserves the same C-level attention as other profit drivers. This means:

Creating a Chief Pricing Officer (or equivalent) role with direct access to the CEO

Establishing pricing as a cross-functional orchestrator rather than just a technical function

Integrating pricing considerations into strategic planning alongside growth targets and cost management

Developing governance structures that balance local flexibility with enterprise-wide consistency

One multi-national firm transformed their performance by explicitly connecting pricing governance to their strategic planning process. By elevating pricing to the executive committee and creating formal connections to sales, delivery, and finance functions, they ensured pricing decisions reflected the firm's overall strategic direction rather than tactical reactions to market pressures.

"Having pricing at the executive table changed everything," their Chief Strategy Officer told me. "Suddenly, pricing became part of our strategic dialogue rather than an afterthought. When we discuss growth targets, margin improvement, or new service offerings, pricing now has a voice in shaping how we'll achieve these goals—not just implementing decisions made by others."

Beyond this strategic elevation, effective governance provides the "freedom of the frame"—allowing professionals to focus their creativity on client solutions rather than reinventing pricing approaches for each engagement.

Back to the CIO

As I explained these connections to my CIO friend, his perspective continued to evolve. "I understand what you're saying," he admitted. "When I think about the vendors who've impressed me most, they're not just offering competitive rates—they're fundamentally changing how they deliver value."

He shared a recent example of a cybersecurity firm that had shifted from hourly rates to a subscription model based on risk coverage. "They didn't just change their pricing," Daniel noted. "They changed their entire approach to working with us. It felt like a completely different relationship."

Exactly. They recognized that pricing isn't just about the number on the invoice—it's about the entire framework for how value is created, communicated, and captured. And they had likely been guided by someone with the experience to see all the interconnections.

"So what you're suggesting," he continued, thinking through the implications, "is that pricing serves as the central coordination point for all these changes. It's not just one component of the business model—it's the thread that connects everything else."

"Precisely," I replied. "That's why this kind of transformation requires deep experience to navigate successfully. You need someone who understands all these connections—and how they influence each other."

"But there's still a language problem here," Daniel observed. "If I went to the partners at my old firm and said 'we need pricing transformation,' they'd think I was talking about rate cards and discount policies—not fundamental business model redesign. How do we bridge that gap?"

It's a crucial question. How do you communicate the scope and importance of this work in a way that transcends the limiting associations of the word "pricing"? How do you help partners understand that this isn't just another tactical initiative but an existential necessity?

"That's where leadership comes in," I explained. "The most successful transformations I've seen start with senior leaders who recognize the scope of what's needed and communicate it effectively. They help partners see the connections between pricing and everything else—how changing one element necessitates changing others."

Daniel nodded. "That makes sense. It's not about forcing change—it's about helping people see the complete picture rather than just their piece of it."

The Journey Ahead

As professional services firms face the AI-driven evolution of billable hours, we have an opportunity: to view pricing as business model connective tissue that makes all other transformation efforts more coherent and effective.

This isn't about minor adjustments to rate cards or discount policies. It's about acknowledging that the fundamental business model that has powered professional services for over a century—selling hours of expert time—is evolving. When AI can complete in minutes what once took days, the connection between effort and value naturally shifts.

The firms finding the path forward aren't just adjusting rates or implementing

new pricing methodologies in isolation. They're seeing how pricing can serve as connective tissue—linking compensation, service delivery, client selection, financial structures, and governance in a more integrated approach.

When these elements work together—governance, finance, client selection, and compensation—they create a framework that makes it easier to know where to experiment, where to accept strategic losses, and how to provide air cover so that partners feel confident in trying new commercial approaches. This integration actually simplifies transformation rather than adding another layer of complexity.

As partners in this journey, we understand the very real challenges in professional services cultures built on autonomy and specialized expertise. Progress happens when:

We collectively explore assumptions about how value is created and captured

Teams find practical ways to coordinate across traditionally siloed functions

Organizations develop capabilities that enhance rather than constrain practice expertise

The current over-indexing on delivery models and under-indexing on compensation and finance would be easier to balance if pricing were included as a peer element rather than an afterthought. Integration simplifies rather than complicates.

So the next time someone says, "But that's not pricing!" when discussing business models, compensation systems, or capital structures, consider responding: "What if viewing it through a pricing lens could help connect these elements more effectively?"

Because in professional services, pricing can serve as connective tissue. It's about creating frameworks for how value is created, communicated, and captured that enhance rather than restrict other organizational elements.

As one managing partner shared: "We spent years working on various challenges independently. When we began seeing how pricing connected to these other elements, transformation became more manageable and more lucrative."

As AI accelerates changes in how work is performed, firms that integrate pricing considerations with other business model elements will find it easier to articulate why clients should pay for results rather than increasingly automated effort.

The question isn't whether your firm needs sophisticated pricing leadership. The question is whether recognizing the broader scope of what pricing encompasses might help connect and enhance your other transformation efforts.

Here's the kicker: As we've described in other articles, implementing the discipline of pricing helps to expose and ultimately improve other areas of the business struggling to optimize in the wake of so much recent disruption. In most firms, it is one of the last areas to be addressed, and its ability to simplify and direct focus toward what is necessary is vastly underappreciated.

In professional services, pricing can be the connective tissue that helps all the other pieces work together more effectively.

Disclaimer: The stories and insights shared in this blog are based on my personal experiences and conversations throughout my career. While some content reflects recent events, they are drawn from a broad range of interactions with professionals across professional services, including friends and colleagues from various organizations, and do not specifically refer to or represent any single employer, past or present. Identities have been anonymized, and quotes may be paraphrased or combined for clarity and storytelling purposes. This post is a personal endeavor and does not reflect the views or proprietary information of any employer.

Comments